Microfinance services have emerged as an effective tool for financing micro-entrepreneurs to alleviate poverty. Since the 1970s, development theorists have considered non-governmental microfinance institutions (MFIs) as the leading practitioners of sustainable development through financing micro-entrepreneurial activities.

‘Ending poverty in all its forms everywhere’ is the first of 17 Sustainable Development Goals set by the United Nations. In absolute terms at the global level there are currently between 1.2 and 1.5 billion people still living in extreme poverty and 162 million children still suffering from chronic under-nutrition, a figure the UN deems ‘unacceptable’.

Poverty reduction has been institutionalised in 1944 when the World Bank was set up.

The World Bank worked through governments and institutions by giving loans to developing countries called structural-adjustment programmes. These programmes were highly unsuccessful, created dependence on aid with little help to poor part of societies.

Microfinance, or the provision of small loans to the poor with the aim of lifting them out of poverty, is a key poverty reduction strategy that has spread rapidly and widely over the last 20 years.

Microfinance encourages entrepreneurship, increases income generating activity thus reducing poverty, empowers the poor (especially women in developing countries), increases access to health and education, and builds social capital among poor and vulnerable communities.

However, more recently concerns have been raised about the real value and impact of microfinance. In the last few years ‘microfinance meltdowns’ have been reported in Morocco, Nicaragua, Pakistan, Bosnia, Mexico and Lebanon. Such concerns raise important questions: does microfinance enable entrepreneurship among impoverished communities that can lift them out of poverty? Is it possible, as some critics claim, that microfinance instead of alleviating poverty actually serves to exacerbate poverty in particular contexts? If so, how? How do the receivers or ‘clients’ of microfinance cope with rising debts that result from incurring microfinance loans? And how does group-borrowing influence social relations between individuals in the group?

The distrust in formal institutions gave the beginning of a shift in developmental thinking that led to the emergence of microfinance. The focus is support of the informal sector by providing credit to help people to pull them above the poverty line.

Microfinance helps these informal micro-enterprises through micro-credit. The micro-credit approach to poverty reduction is “the provision of small loans to individuals, usually within groups, as capital investment to enable income generation through self-employment”. The informal businesses of poor are referred as a type of un-met demand for credit.

Poverty is considered as the outcome of market failure, microfinance would correct the market failure, providing access to credit to the poor. Credit would create economic power that would generate into social power, lifting the poor out of poverty.

The purpose of Cooperative Credit Union

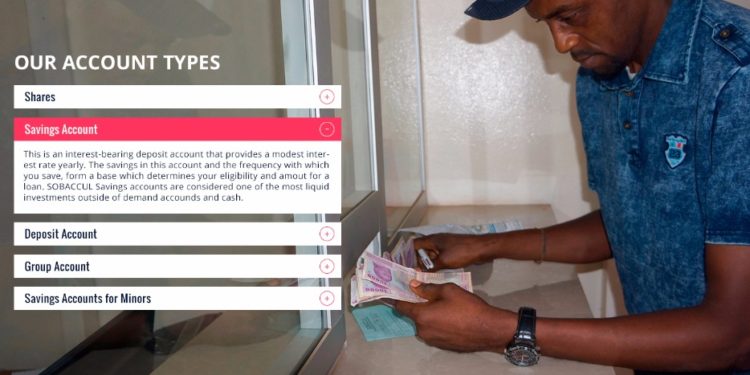

The United Nations (UN, 2005) defines microfinance as the provision of financial services and the management of small amounts of money through a range of products and a system of intermediary functions that are targeted at low income clients. Credit Union is defined as a group of people who are united by a common bond, and voluntarily organize themselves into a cooperative society to save their money together and to give loans to one another at a low interest rate to the benefit of members. Similarly, the Soba Cooperative Credit Union (SOBACCUL) defines a Credit Union as a financial Co-operative society organized to promote thrift, encourage savings and create a source of credit for its membership by pooling their savings together to obtain loans at reasonable interest rates.

The above definitions present the Credit Union as a non-banking financial co-operative formed by interested members or a group of people having a common bond of either occupation, profession, clubs and associations, members of a community, among others, who pool their savings together in order to obtain a loan at fair and reasonable rates of interest for worthy, productive and provident purposes.